My Article: My Dream for 2012 Bordeaux - Low Prices

It’s been a reoccurring dream in my life as a wine critic – and it happened last night. It’s usually right before I leave for Bordeaux to taste the newest vintage from barrel.

It’s been a reoccurring dream in my life as a wine critic – and it happened last night. It’s usually right before I leave for Bordeaux to taste the newest vintage from barrel.

It’s essentially what I do during my trip to Bordeaux every spring: I visit wineries. I speak to winemakers and vintners. And I taste lots of barrel samples – usually about 500, or so.

This is what I will be doing next week in Bordeaux when I evaluate the region’s newest wine on hand – 2012. I must admit that I don’t have high expectations. The vintage is certainly not something like the great 2009 or 2010. It may not even be very good but not exceptional, like the 2001, 2004, 2007, or 2008.

Some already say it’s better quality than 2011, which I liked, but it’s only a good to very good quality vintage, thanks to all the hard work in the vineyards and wineries to get the best quality grapes and wines possible.

I will know soon enough. It’s a fascinating process as a trained journalist as well as a wine critic. As many know, 2013 marks the 30th year I have been professionally tasting barrel samples.

But there is something that keeps popping in my head: It’s the price for 2012.

I know I shouldn’t be thinking about it. But even in my dream, I was thinking about the obvious. I have heard many times to “evaluate the quality of the wines and worry about price latter,” but I can’t help it.

I know I shouldn’t be thinking about it. But even in my dream, I was thinking about the obvious. I have heard many times to “evaluate the quality of the wines and worry about price latter,” but I can’t help it.

The 2012 vintage could be an excellent opportunity for the top Bordeaux chateaux to “relaunch” their wines in the minds of key wine buyers and consumers around the world. But they are going to have to cut prices drastically. Last year, many really blew it with their pricing for 2011 futures, or en primeur, and didn’t drop their prices enough. Few people wanted to buy any with prices only a third or so less than 2010.

Most top wine merchants in the world sold less than 10 percent of what they did with 2010 or 2009. Some didn’t sell any 2011. And the word I hear, especially in Hong Kong, is that no one is going to buy 2012 unless the wines are offered at reasonable prices for the top names.

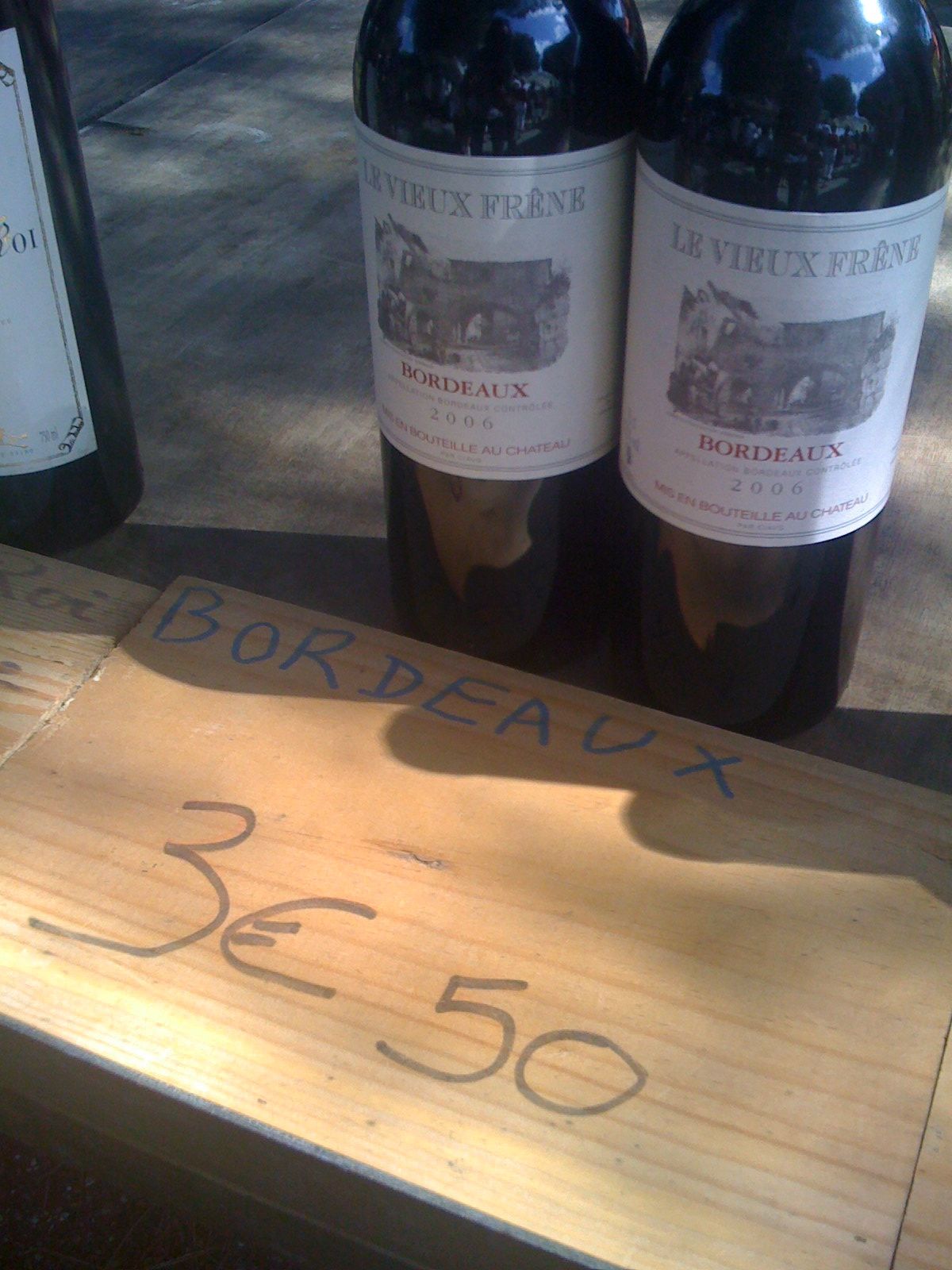

I suggest 2008 opening prices for the first growths – this means Margaux, Lafite and the rest at 100 Euros to the negociants in Bordeaux. They did it with the 2008 vintage. Why can’t they do it with 2012?

This would mean consumers could buy first growths for slightly more than $200 a bottle as futures. Super second growths would be just over $100.

I spoke to some serious wine sellers in Hong Kong and they said they couldn’t sell 2012 first growth en primeur to their customers – big buyers in PRC – unless prices were around HK$2,000, and the US$200 would be substantially less.

Alas, this reoccurring dream in my life as a wine critic focusing on Bordeaux doesn’t seem to end right for the consumer – at least as far as prices for futures. I already hear that first growths are discussing releasing 2012 at double my suggestion.